China’s post-covid recovery is slower than most expected.

- Have China’s economic potential and business opportunities gone down?

- What is China’s leadership economic strategy?

- Where will China’s trajectory bring it in 2024 and over the next few years?

- What opportunities does it mean for international companies and what risks should they mitigate for?

China’s latest economic results and the experience of companies on the ground provide insights than can be very valuable for the new strategies that international companies need in China.

Why is China’s economy slowing down?

A number of events that occurred during the Covid-19 years have changed China’s economic situation. Though they have their source in the second half of 2020, they are independent from the pandemic itself, which, together with the geopolitical tensions of 2022, played only an aggravating role.

Still, the events that unfolded in the three pandemic years (from 2020 to 2022) have put China on a trajectory that will be very difficult to reverse.

International relations developments have not been as smooth as the economic ones, however:

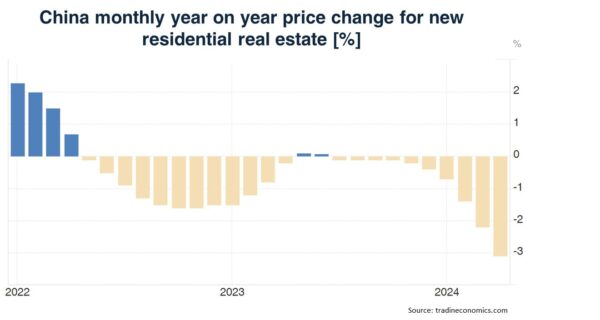

The real estate crisis

It started with the decision by the central government to puncture the real estate bubble. In August 2020, new regulations imposed limits on how much money real estate developers could borrow according to their financial situation. It triggered the much talked about defaults and bankruptcies of many of China’s real estate giants. Though apartment prices were carefully controlled by local government to avoid a crash of the market and a big drop in real estate prices, the value of the homes owned by the population dropped steadily. This became perceptible from the second quarter of 2023 and the decrease accelerated in 2024.

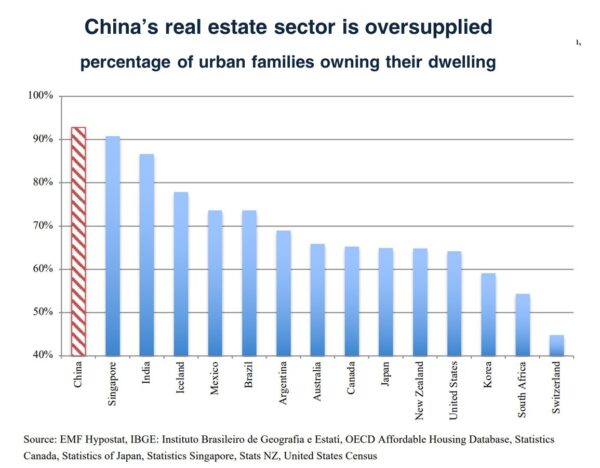

This development was unavoidable because the real estate industry was clearly in a bubble. In 2018 already, 88% of new homes sold were bought by families that already had a house and over 90% of Chinese families owned their dwelling[1].

Besides, China’s total population started to shrink in 2022 and its decline accelerated in 2023[2].

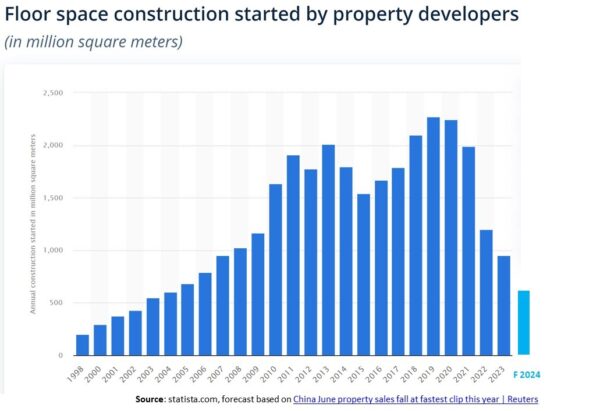

With less inhabitants and most of them owning their homes, there is little need for more housing in China. The result has been a steady drop in new construction starts which will eventually leave the real estate industry to work on replacement and refurbishment of old homes.

China’s real estate sector and its dependent industries (home decoration, household appliances, for example) was deemed to account for 25% or more of the Chinese economy. The sharp drop in this important sector’s activity has obviously resulted in lost jobs and business opportunity impacting growth negatively.

But the reduction in household wealth is certainly an additional indirect effect holding back consumers. Indeed, estimates indicate that about 70% of Chinese citizen’s wealth has been concentrated in real estate[3].

Faced with home prices declining even faster in the second-hand market, the Chinese middle class has seen its main store of wealth shrink.

But a second event has compounded Chinese families’ feeling of declining wealth.

The reining-in of the big private tech companies

in November 2020, shortly after funding to real estate developers was put under control, the Chinese government stopped the IPO of the Ant Group a week before it was due to happen. (The Ant Group was the Alibaba company providing financial services directly to the users of the Alibaba group of internet companies.)

In that same month of November, the Chinese authorities summoned 27 major internet companies to a meeting instructing them to correct monopolistic practices, unfair competition and counterfeiting[4].

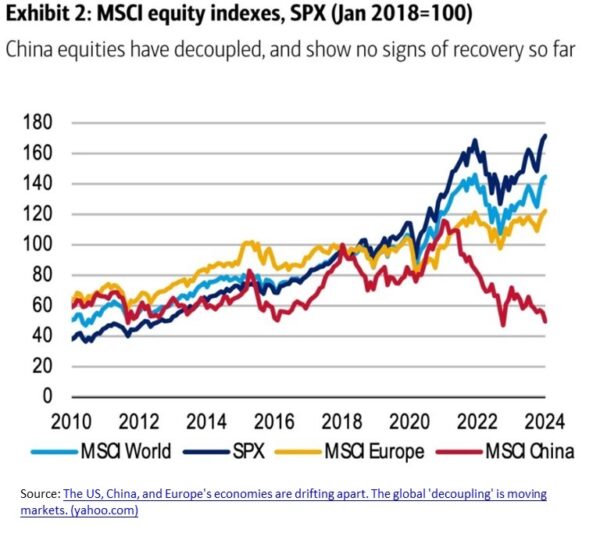

Fine were imposed and China’s drive to control the practices of the big tech companies, while probably needed, had a very negative impact on China’s stock market. It lost over 50% of its value in the 22 months from its peak on the 1st of January 2021 until the end of October 2022. After a mild recovery, the index was back at the October level at the end of June 2024. (This has made China’s stock market the worst performing market of all major economies in the same period.)

A large majority of Chinese households have invested in the stock market and financial products that are linked to equities. When combined, real estate property and stocks account for more than 80% of Chinese individuals wealth, on average.

Seeing their wealth steadily decline, Chinese families had a prudent, traditional reaction: they saved and reduced their consumption. It has further reduced China’s growth potential and put additional pressure on the job market, already weak from the jobs lost to the end of the real estate boom.

With slower growth, job opportunities declined as well, further compounding the feeling of economic insecurity of the population. (This also appears in section 2.2 of the 2024 Swiss Business in China Survey: retaining employees has become easier over the past 2 years.)

Supply chain disruptions and the de-risking of foreign firms

China controlled the pandemic by locking down Wuhan, closing its borders and applying a zero tolerance to the virus. This allowed China to supply the world in the second half of 2020 and in 2021 at the time when the pandemic disrupted the rest of the world industrial production capacity. But in April 2022, the much more contagious Omicron version of the virus started to spread, forcing a two-month lockdown of Shanghai. Due to the importance of the port city and the Yangtze Delta region, the lockdown disrupted international supply chains importantly. And it made many international companies and the world aware of its dependencies on China’s production capabilities.

In addition, three months after the end of the lockdown, in August 2022, China reacted strongly to Nancy Pelosi’s visit to Taiwan. (At the time, she was the third person in line to the US Presidency after the President and the Vice-President.)

Coming after Russia’s unprecedented and unexpected attack on Ukraine in February 2022 and the immediate sanctions that ensued, the risk of war in Asia suddenly had to become part of most international companies’ considerations. It was not anymore farfetched that trade restrictions could be imposed on China as they were on Russia and mitigating geopolitical risks in Asia became part of the world’s multinationals strategies.

In the 40 years of China’s opening and development, foreign businesses only had to consider China’s and international economics to define their strategies. But in the space of a few months, they unexpectedly needed to consider their China supply chains risks, that the Shanghai lockdown had put in stark perspective a few months earlier.

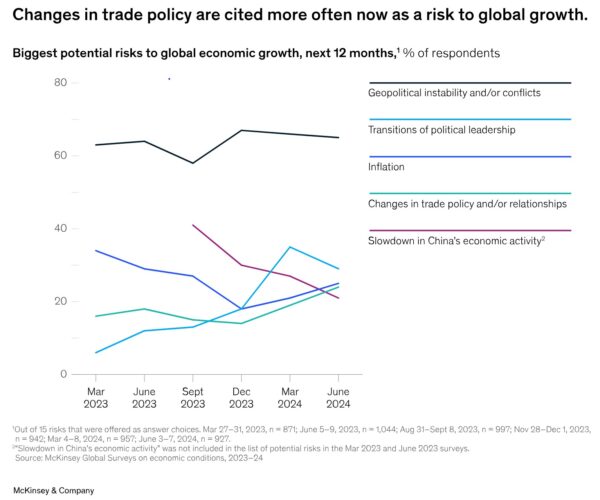

Needless to say, the possible election of a protectionist US President who promised to be impose 60% tariffs on all Chinese good entering the USA has kept that risk well alive in business leaders’ minds, as this June 2024 global survey of CEOs highlights[5].

As a consequence, before the end of 2022, international companies started shifting their supply chains out of China. The suppliers of these multinationals have been the first to feel the impact of the new de-risking atmosphere[6].

A well-known example is Foxconn, the major contract manufacturer for Apple products based in Taiwan. It is the biggest private employer in China since 2011 and provides jobs to 1 million Chinese. It used to manufacture practically all Appl products in China until 2020. In in fiscal year 2023[7], Foxconn produced 14% of the world iPhones in India, twice the amount (7%) it made there in fiscal 2022.

The companies transferring production out of China still rely for a large part on components made in China. However, when suppliers set-up production out of China they also look for lower costs production bases. It is then quite likely that these components will also be localized step by step in Thailand, Vietnam, India or Mexico or other new manufacturing destination, as it happened in China when it became the manufacturing country of choice.

International trade is an important part of China’s economy: it accounts for about 20% of China’s employment[8] which is now probably more than the real estate industry does today.

When keeping in mind that China based foreign-invested companies were responsible for 31.5% of China’s exports and 35% of its imports in 2022[9], both international trade and foreign direct investment are critically important to China’s economy.

It is then no surprise that the Chinese government is putting enormous effort to rebuild its global economic relations. Still, the ongoing international de-risking process will unavoidably continue to put pressure on China’s economy. Additionally, it will have a negative impact on high-quality job opportunities in China and further contribute to Chinese consumers’ malaise. It is a fact that the international companies de-risking their China supply chains are from the most developed economies, which in turn also provide the higher-skill and better-paid jobs[10].

China’s economic policy and response to maintain fast growth

The dual circulation strategy

Faced with a stagnating population, there are limits to growth generated by a larger number of consumers. As new jobs are still created in the cities, the rural-urban migration continues to happen. It will however be limited by the shrinking working age population and the number of jobs that China can add every year.

China employed 740 Mio people in 2023 and expects to add 12 Mio new jobs in 2024. Assuming in a simplistic way that these newly employed citizen will earn China’s average salary, this would add 1.6% to the employed population and potentially generate the equivalent growth in GDP.

In order for growth to be higher, China needs to increase everyone’s average income as well (and the increase needs to be higher than the inflation to generate real growth).

To achieve higher margins and to pay for salary increases, businesses in China must sell better products and services, commanding higher prices and margins; or sell their products and services at the same price but produce them more efficiently, at lower costs.

The Chinese leadership’s intention and policies is to deliver this additional margin and efficiency through the development of technology and innovation.

Indeed, innovation and particularly technology innovation allow to both produce better products and services as well as to make them more efficiently.

This focus on innovation has an additional advantage from China’s leadership point of view: it increases self-reliance, which in turn is seen as a necessary element to reduce China’s dependance on technology import and to increase its security.

Still, keeping in mind the importance of China’s foreign trade and investment, China’s leadership intends to achieve these goals while maintaining its international economic relations, both because of the valuable job opportunities it provides to China’s population and because international cooperation allows faster technology improvements.

The twice a decade recently concluded Plenum of the Central Committee Communist Party (the “third plenum”), which traditionally focuses on economic issues, re-emphasized this concept of “dual circulation” economic strategy: localizing domestic production and sales, as well as increasing imports and exports.

The third plenum also stressed the focus on innovation: “education, science and technology, and talent function as a basic and strategic underpinning for Chinese modernization.”[11]

To achieve its goals the Chinese government is offering considerable subsidies and incentives to specific industries (the semiconductor development and production is a well-known example) as well as to R&D activities in general. It is noteworthy that wholly owned foreign companies established in China can also obtain these subsidies.

The Chinese consumers confidence trap

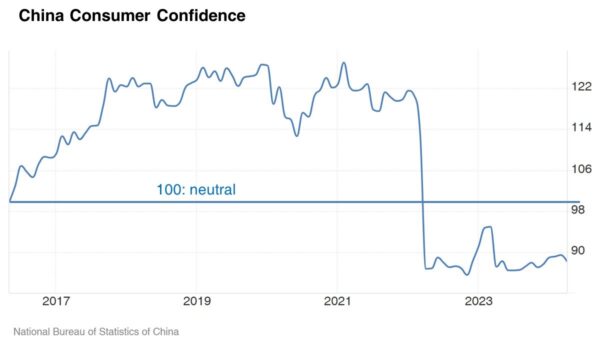

The third plenum did not however strongly address the Chinese consumers’ decreasing spending enthusiasm, though consumers’ confidence is unprecedentedly low.

Since April 2022, the confidence index (published officially by the National Bureau of Statistics) has been around 86 with the exception of the rebound that happened in early 2023 when China cancelled all pandemic control measures.

The lowest the index has been, since it has been recorded in 1990, is 97. The figure 100 as a neutral confidence feeling of consumers, on average.

The third plenum was followed by the announcement of a government program to subsidize the replacement of old and energy inefficient cars and household appliances with more sustainable ones to reduce CO2 emissions and promote domestic consumption[12]. Yet, economists generally believe that it is not enough to reverse the downward spiral initiated by the consumers’ loss of confidence, compounded by their lower economic opportunities in a slower growth environment.

The promotion of investments to maintain growth causes overcapacity and trade tensions

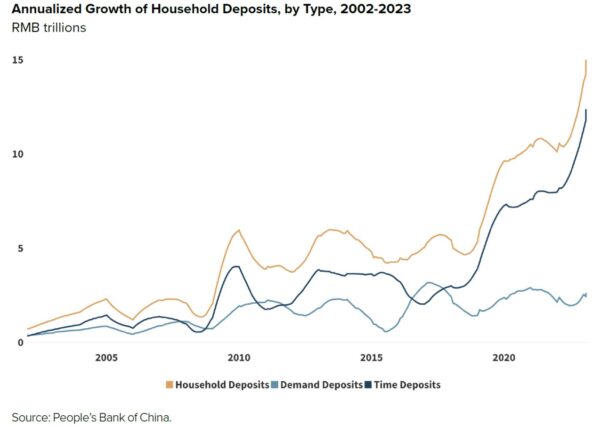

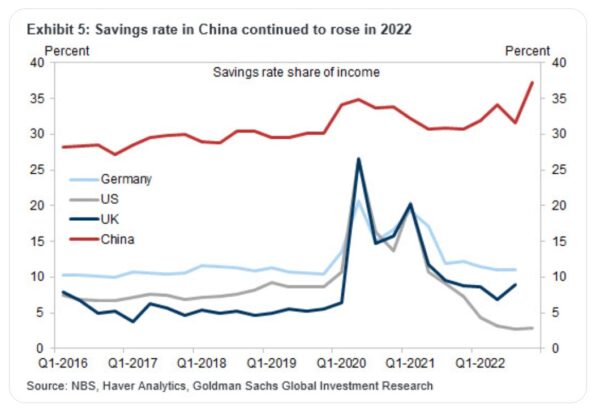

Chinese consumers are definitely spending more frugally than in pre-pandemic years. (Domestic retail sales growth for the first 6 months of 2024 reached 3.7%, which only about half what it was in pre-pandemic years.) But it does not mean that Chinese do not have money. It is quite the contrary: households have saved during the pandemic as consumers did in other regions of the world, but contrarily to the rest of the world Chinese have kept saving, post-pandemic.

In fact, Chinese have even increased their savings rate. They are now saving more than 35% of their income, while Germans, for comparison, save a bit over 10% (and Americans just about 3%).

Since the stock market is uncertain Chinese use their savings mostly to reduce their mortgages and to store in time deposits, in their banks.

Banks need then to loan this money out and get interests from their clients, because if they did not, banks would not be able to pay deposit interests to their Chinese depositors.

Before 2020, these bank savings where partly loaned directly or indirectly (through financial products) to real estate developers who bought land-use rights, built apartments and sold them to individuals. This activity provided important revenues for local governments since they are the owners of the land. (Land sales were estimated to account for one third of local governments’ incomes.)

Now that the new construction starts are about one third of what they were at their peak (in 2019 and 2020), these savings need to find new investment destinations. To compensate the missing land sales to real estate developers, local governments are aggressively promoting investment in industrial and manufacturing operations, which also provide revenue through income and value-added taxes.

The result is an uncontrolled investment boom in sectors that are seen as very promising, such as electric vehicles, battery manufacturing and other green technologies.

To take the example of electric vehicles, at the time of writing there were over 100 manufacturers of EVs in China (and 500 were in activity in 2019!)[13]. The unsurprising consequence of this rush to promote EV manufacturing is severe underutilization of the automotive manufacturing capacity of China, 35% of which was idle in Q1 2024[14].

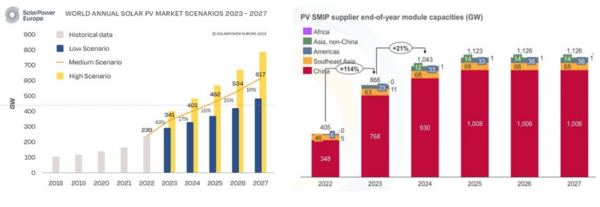

The solar panel industry is another case in point. China’s expected production capacity in 2024 is of 900 GW[15]. At the same time, world demand is expected to reach around 400 GW[16]. In other words, China has the capacity to produce twice the total quantity of solar panels that the world will need in 2024.

This overcapacity has predictably been spilling over China’s borders and created protectionist reactions from other countries. The USA has led the way by imposing (among others) 100% import taxes on Chinese EVs. The EU is following (albeit with lower proposed tariffs and negotiations are ongoing with China to see if an arrangement can be found).

This reaction is however not limited to developed economies. Among others, on 2nd July 2024, Indonesia announced up to 200% tariffs on certain low-cost Chinese imports[17]. Brazil imposed quotas on a number of steel products and it is also ramping up import duties on EVs that will reach 35%[18].

China’s investment-driven growth model is bound to lead to slower growth

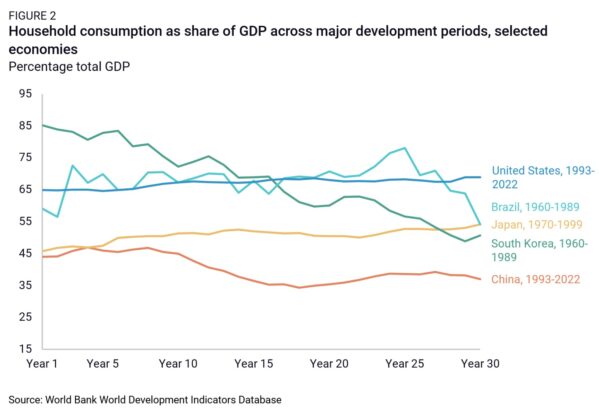

China’s high levels of savings and therefore high levels of investments are the result of Chinese households’ low level of consumption.

Consumption as a percentage of GDP is much lower in China than it is and was for any other economy at a similar stage of development. And now that the real estate sector is no more able to absorb China’s high savings, manufacturing is becoming overinvested.

China’s high level of investments will unavoidably generate trade tensions

Due to the size of China’s economy (the second in the world in absolute USD terms and the first in purchasing power parity), these levels of investment going into manufacturing will require that the rest of the world reduces significantly its own share of manufacturing to absorb the Chinese production that is not consumed in China.

At the same time both the US and the EU (and India) are taking a page of China’s playbook and are building up their own manufacturing, with large government incentives.

It is therefore very unlikely that China will be able to further increase its manufacturing investments and export its overcapacity[19], [20].

In that situation, the economists’ calculations reach the conclusion that, without reforms to transfer sufficient income to households to boost consumption in China, the country’s growth must eventually go down to 2-3% per year, until its economy is rebalanced. (i.e. investments and consumption are in a proportion that fits China’s economic development)[21].

The past experience is that no country in a situation similar to China’s has previously managed such transfers because they go again vested interests (in China’s case mostly the local governments and businesses that work for them).

If one country in history would be able to carry out such transfers, it certainly is China given its strong central government authority. Yet, at this moment, no decision to transfer wealth to households (either through higher wages or more generous social security) has clearly been made, though a growing number of Chinese economists recognize the need to do so.

Based on this macro view, what should we expect in practice?

China’s leadership is used to achieve what it sets out to do. It is therefore likely that Chinese leaders will use all their resources and experience to continue achieving relatively high growth rates (4.5- 5%) for the years to come, try to avoid the erection of trade barriers against Chinese products and continue increasing their exports to the world.

We can expect that it will work, at least in many markets and for some time. In fact, exports from China grew by 3.8% in the first 6 months of 2024, compared to the same period in 2023; and the June 2024 trade balance hit a monthly record of USD 99 Bio. indicating that consumers buy less imported products (which amount to import substitution).

We should however also expect that, over the next few years, protectionist actions of major economies (and of some under developed ones as well) will be put in place and reduce China’s export potential.

As a result, the already brutal competition within the Chinese market will only intensify and continue to bring producer prices down (China’s Producer Price Index has been in negative territory since September 2022). Very low inflation is also likely to continue to prevail. (China’s inflation was 0.2% in 2023 and 0.1% in the first half of 2024.)

With low inflation and a reduction of interest rates abroad, China will also be able to continue to lower its own benchmark rates and make its manufacturing base more competitive.

Incentives to favor technology development, innovation, the green economy and import substitutions, among others, will be ramped up to follow China’s strategy that was declared at the third plenum, also supporting further competitiveness of Chinese producers.

Nevertheless, if consumption does not revive, growth will most probably slow further to reach and stay at a level of 2-3% for longer than a decade, the time it will take for excess investments to be depreciated and consumption to become the main driver of the economy.

But a low economic growth does not mean the absence of business opportunities. After all 2-3% is at the higher end of the expected growth of the USA and the EU and the size of China’s economy in itself provides considerable opportunities, even with no growth.

In addition, efforts and incentives to develop technologies locally will certainly bear fruits in specific sectors, which will grow at much faster rates than China’s economy overall.

To take again the EV example, China has become the most efficient location for the production of EVs and their subsystems. EV manufacturers may also be at the front of the new connected mobility and autonomous driving. This does not only make China’s automotive market the largest in the world, it will probably also make it one of the most dynamic. China’s automotive ecosystem will generate needs for countless products and services that many Swiss, EU and US companies can fill.

The country is also likely to become the main production hub for legacy semi-conductors. In so doing it will need the support from business ecosystems that are based out of China.

Chinese shipbuilding makes 46% of the worldwide shipping capacity also needing a large supplier base.

The medical market is growing as fast as the country is aging and getting wealthier, requiring new drugs and medical devices and developing new ways to provide healthcare. Affluent Chinese value high quality imported food and, though they are cutting down on luxury purchases, the best brands continue to see growth[22].

These are some examples of dynamic sectors that will provide considerable business opportunities. Other specific sectors will emerge out of China’s push for innovation, which will also grow much faster than China’s average.

What is next, then, for international businesses in China?

This new period of economic rebalancing China is now entering will bring many opportunities, but it will also come with more risks than foreign investors have been used to.

There are no indications that foreign companies are leaving the market. We do not know of any Swiss one which closed its operation in China, though we heard of companies with no local presence that decided to stop selling in the market. In fact, if ever, the companies doing business in China without their own local presence are setting up shop in order to better serve their customers and keep their position in the market.

Abandoning the second largest market in the world is not a reasonable option for most businesses that are successful in China.

And the companies active in the fast growth sectors are investing further. At the end of last year, Clariant opened a new plant dedicated to anti flammable materials for EV batteries[23].

An SME producing adhesives specialized for glueing foams ships from Switzerland to China a growing number of containers for automotive and furniture applications.

Ypsomed is building a 15’000 sqm facility to localize its production of insulin pens[24]. Straumann is investing CHF 170 Mio in its Shanghai campus and production facility[25].

To mitigate risks, most new investments are made in China with the purpose of serving the local market. For these “local for local” investments to be successful, it is important that they are planned with the intensifying competition in mind: efficiency, optimal investment and running costs need to be inbuilt in the concept from the outset and all local available incentives applied for. Reducing financial risks can be done by obtaining loans from local banks, which are eager to find good projects to fund and provide attractive interest rates.

Continuous sales success will depend on providing best products and developing well recognized brands on the Chinese market (section 1.3 of this survey reports provides detailed insights on these aspects). And high operational efficiency will be needed to maintain good returns.

To mitigate risks against trade barriers or sanctions, the foreign businesses which export from China an important proportion of their production are setting-up additional operations in other low-cost or best-cost countries. In so doing they offer an alternative to their customers who want to de-risk their supply chain. This “China +1” strategy is an effort that requires management resources, additional investments and a new learning curve. Still, it is considered a worthwhile insurance policy against uncertain geopolitics.

But China’s development plan also offers opportunities to new comers who can supply new products and technologies. The push for technology and innovation is generating a strong need for high quality technical products, components and equipment that international companies, and particularly Swiss ones, are well placed to fulfill. Though China encourages import substitution for mature technologies, fast development requires that advanced and new technologies, highly efficient equipment or smart innovations be imported.

China is probably the country that has benefited most from the past 30 years of globalization, its leaders are very much aware of it and they intend to further promote openness and free trade. The recent decision they made to discuss an upgrade of the Sino-Swiss Free Trade Agreement is a good illustration of their will to promote the external circulation part of China’s dual circulation strategy.

Be it as a local player producing and selling in China or as an international provider importing into China, its market keeps providing important opportunities. The business environment is not easy and it will grow more competitive. But those who are successful in China will be assured to be very competitive worldwide!

[1] Peak China Housing by Kenneth S. Rogoff & Yuancheng Yang – August 2020, Peak China Housing_2020_08_12 (nber.org)

[2] China’s population drops for second year, with record low birth rate | Reuters

[5] Economic outlook, June 2024 | McKinsey

[7] Apple made $14 billion worth of iPhones in India in shift from China (cnbc.com)

[8] Chinese economy’s export pillar shows cracks from global slowdown | Reuters

[9] China: foreign companies share in import and export 1986-2022 | Statista

[11] China’s Third Plenum Embraces a ‘New Development Philosophy’ – The Diplomat

[13] Electric vehicle industry in China – Wikipedia

[14] Industrial Capacity Utilization Rate in the First Quarter of 2024 (stats.gov.cn)

[15] PV Supplier Market Intelligence Report (Q2 – 2024) — Clean Energy Associates (cea3.com)

[16] Global Market Outlook For Solar Power 2023 – 2027 – SolarPower Europe, Fig 16

[17] Indonesia Announces Hefty Tariffs on Chinese-made Goods – The Diplomat

[18] Brazil imports of Chinese electric vehicles surge ahead of new tariff | Reuters

[20] Transcript: Huang Yiping & Tu Xinquan decode Third Plenum (pekingnology.com)

[21] The Only Five Paths China’s Economy Can Follow – Carnegie Endowment for International Peace

[22] LMVH and other global luxury brands are hurting as Chinese shoppers rein in spending | CNN Business

[23] Clariant Opens New Production Facility in Huizhou Daya Bay (echemi.com)

[24] Go-ahead for a new Ypsomed production facility in China – Ypsomed – Group