Chinese companies have evolved from being producers to become developers of products. Their local market is saturated and they are now going global. How will this play out for legacy international enterprises?

——

Last year we analyzed the economic situation in China, the reason for the manufacturing overcapacity and the direction we expected that China would take: essentially no significant change to the policies of boosting high and new technologies, together with localization of imports; all of it resulting in a model relying on more Chinese exports. (See “China – Quo Vadis: What happened to China’s economy?” to understand China’s current economic situation.)

By end of November 2025 China accumulated a USD 1’000 Bio. trade balance, its highest ever.

This December Central Economic Work Conference did mention the necessity to encourage consumption, but it remains a second priority to the development of the industrial base. With not many policy changes to be expected, with this year’s analysis we focus on the economic consequences we can expect from China’s research and technology push forward.

——

In 2000, China entered the WTO, opening the world’s markets to its products. At that time, China accounted for less than 4% of global GDP and 6% of world manufacturing, while the US was responsible for 25% of world manufacturing, ahead of Japan (11%) and Germany (8%).

A large number of companies, from both the US and the world’s other developed economies, took advantage of China’s low costs and government development incentives to source components or to move their production to China.

This delocalization generated considerable profits for multinationals and other enterprises that took advantage of the low production costs that China offered. Consumers in developed countries were key beneficiaries of this trend as their buying power increased.

Meanwhile, Chinese entrepreneurs built manufacturing empires in one generation. Together with the multinationals that set-up shop in China, they provided new employment and buying power opportunities for hundreds of millions of Chinese that became avid consumers of international companies’ products—from Kentucky Fried Chicken to Louis Vuitton bags.

Apple, was arguably one of the biggest winner from these production and market opportunities, becoming the world’s most valuable company in Q3 2011 and capturing 10% of the Chinese smartphone market. China became the Workshop of the World and, by 2010, it was established as the largest manufacturing nation on the planet.

Swiss companies — along with those from other developed nations — benefited tremendously from China’s manufacturing rise.

——

Today, China accounts for about one third of global manufacturing, more than the US, Japan and Germany combined.

By October 2025, Apple’s sales have grown to account for 25% of the Chinese smartphone market, generating 14% of worldwide sales (in Q3 2025). This progression illustrates how much US corporations have benefitted from China’s development, despite the loss of domestic jobs caused by transferring production to China.

Still, while up to 2 million US manufacturing job losses have been attributed to delocalization to China, very few Swiss companies followed this path. This is the case because China’s manufacturing rise happened at a moment when Swiss companies were already focusing on niche and hi-tech products that they sold worldwide — including to China — with limited competition. So, when Swiss companies established manufacturing facilities in China, they did so largely to produce and sell their products into the local Chinese market, rather than to replace production in Switzerland. The recent opening of Straumann’s dental implant campus in Shanghai did result in some job losses in Switzerland, but the products made there by Straumann are all intended for the Chinese market.

As a result, it is fair to say that the “first China shock” — China’s transition to become the world’s manufacturing superpower — has brought only benefits for Swiss companies and consumers. Additionally, during these first two decades of the 21st century, Switzerland has had a steady and positive trade balance with China, as have other developed and technologically strong countries, such as Germany and Japan.

——

From Workshop of the World to Technological Powerhouse

Switzerland is forecast to maintain a positive or balanced trade with China in 2025.

However, German’s exports to China have dropped by 11% while Chinese exports to Germany have increased by a similar percentage, generating an estimated trade deficit of USD 100 billion for Germany in 2025 [1].

How did that happen?

The short answer is the fall in German car manufacturer’s share of the Chinese market over the last few years. Mercedes Benz sales dropped by 27% in China in the first 9 months of 2025, a striking example of such developments [2]. In fact, this situation has its origin in two key decisions made by China’s leadership many years ago.

In 2006, China launched its 15-year “National Medium and Long-Term Plan for the Development of Science and Technology (MLP)”, with the target of bringing China up to the level of R&D spending typical in developed nations.

In addition, in 2009, China’s Prime Minister announced that the country had made the decision to leapfrog automotive internal combustion engine technology and instead focus on developing electric vehicles.

The MLP bore fruit: from 2019, China has been the leading international patent filer under the Geneva World Intellectual Property Organization international filing system. Huawei has been the top patent filing company worldwide for the last 8 consecutive years. Unsurprisingly, 50% of Huawei’s workforce is engaged in R&D (equating to 50,000 engineers). In addition, China has produced the highest number of the most cited scientific journal articles in the world since 2020.

Meanwhile, it is estimated that the Chinese government has invested up to USD 250 billion to promote, develop and gain acceptance for EVs in China. As a result, 11.6 million EVs were sold in China in the first 11 months of 2025. Overall, China is on track to produce about 70% of the world’s electric cars in 2025.

These developments happened in an incredibly dynamic manner.

In the past 15 years, 400 new EV brands have been launched in China, 100 of which are still in the market, though only four are profitable. Eventually, experts predict that only 10 to 15 brands will survive. To attract consumers, Chinese EV makers develop new functionalities at breakneck speed. Autonomous driving works well in the country, and although drivers are still required to keep one hand on the steering wheel, their cars independently park themselves after the driver has left the vehicle. Looks and feeling is another avenue for EV makers to differentiate and grab market share from traditional luxury brands.

In cooperation with legacy state-owned car producers, Huawei has now launched an ultra-luxury electric sedan, the Maextro S800, selling for USD 150,000.-.

——

Amid this environment of brutal competition and mushrooming innovation, German car makers had practically no competing product to offer. Only Tesla was prepared, with an EV production facility operating in Shanghai since 2019.

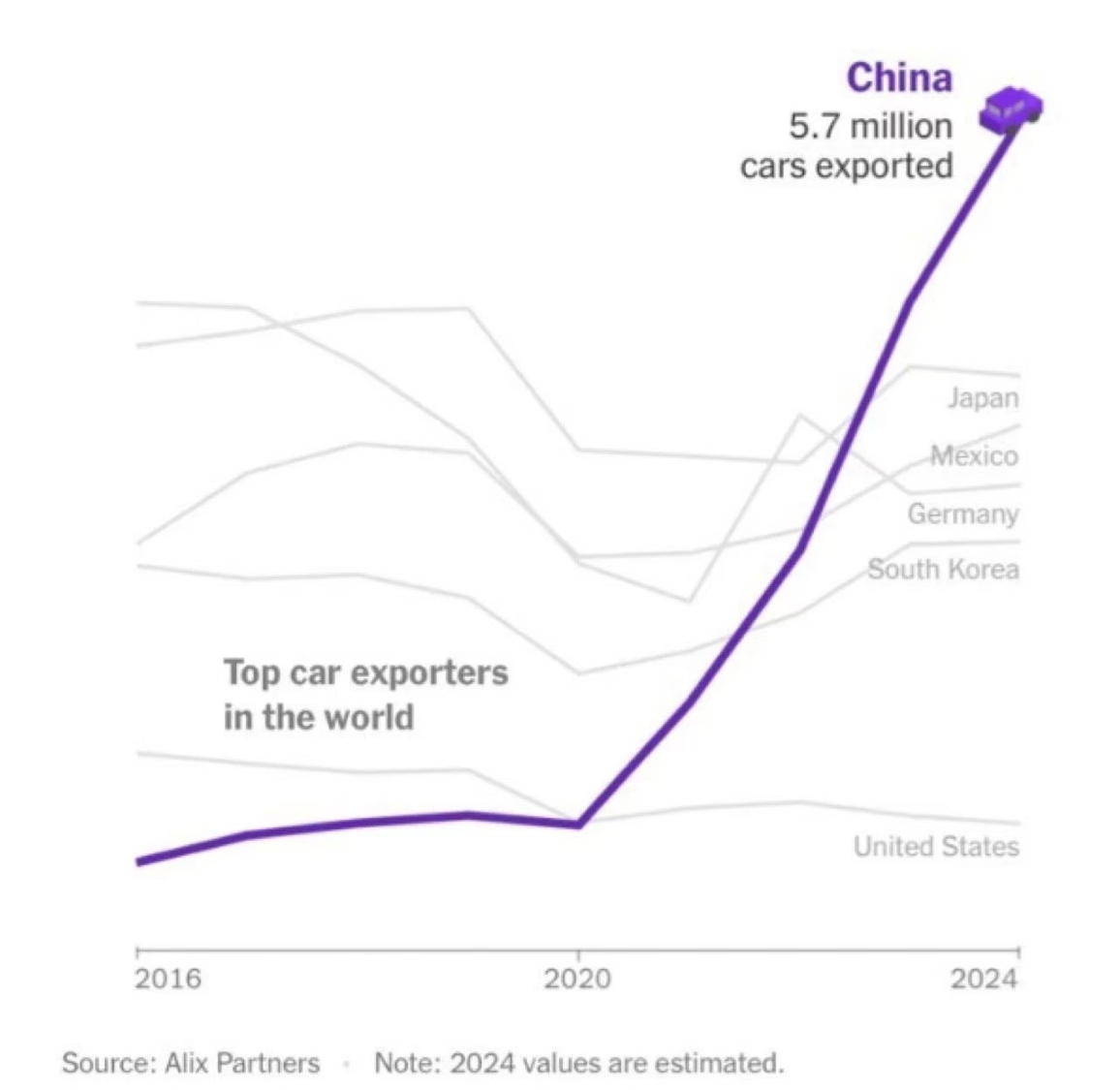

But that is not enough to fill the over-capacity that has been built up. To maintain their profit levels, the largest Chinese EV companies are exporting. The numbers are staggering: the first 10 months of 2025 have seen a 90% increase in electrical cars exports! Since last year, China is the largest exporter of cars in volume.

——

From EVs to all technologies

The MLP project was complemented by the “Made in China 2025” program launched in 2015. It set a number of detailed objectives in terms of the localization of technologies and products. To a large extent, it has been successful. Indeed, supported by universities, partially government funded private equity, and local governments eager to increase their GDP, Chinese entrepreneurs are launching a plethora of new companies in all imaginable fields, from medical devices to machinery, electronics, software and lab instruments. New government procurement rules coming into force on the 1st of January 2026 will incentivize further localization.

Biotechnology, one of the sectors where China is lagging developed economies, is expected to follow the same pattern in the coming years. Many Swiss companies we are in contact with see dozens of new local competitors appearing over the space of just a few years.

Initial results of the 2025 Swiss Business in China Survey (to be published very soon) confirm that these individual examples are part of a general picture. More than 50% of the survey’s respondents consider that their Chinese competitors’ advantages now lie in “Brand recognition”, “Product (quality, innovation)” and “Technology”, numbers that were just a third or a half of these levels three years ago.

Together with the insights from Swiss companies in China, the radical changes in the Chinese electric car market provides a clear indication of what other industries can expect; if they find themselves unable to develop new products at Chinese speed, they will be unprepared to compete.

Still, Swiss companies express growing confidence about their prospects for success in the Chinese market, particularly over a 5-year time horizon. Additionally, they are increasing the amount of R&D done in China for the rest of the world.

China has been a remarkable source of good, cost-efficient products. For international companies to remain competitive in China and in the rest of the world, it may now be time to take advantage of China’s fast and cost-efficient engineering capabilities as well!

——

References

[1] Source: Germany faces record trade deficit with China | Reuters

[2] Source: High-end car sales sink in China as its economy slows, taking a toll on European automakers