News about China affecting business decisions kept coming in the past months. Additionally, China just concluded its twice-a-decade parliamentary sessions where both the new Foreign Minister (Qin Gang) and the President directed strong words at the USA. We thought of providing you a short update and some initial insights.

Let’s start with what matters most to businesses:

The Economy

- Covid is not a concern of everyday life anymore. No masks are requested anywhere in public places (including in public transportation). The experience in the country is that covid times are like a fast-fading bad dream, even though the flu is becoming some sort of a concern with some schools in Xian being temporarily closed.

As expected, consumption is restarting. Having travelled to Hangzhou, the tourism capital of Hangzhou, we can attest that traffic jams are back and touristic spots are packed with local travelers. This was so, even in February when the weather was cold and unpleasant.

Statistically more relevant is the service industry Purchasing Manager Index (PMI from Caixin/S&P Global), reaching 55 (a reading over 50 means business expansion), the highest since July 2022 (at 55.5, when recovering from the Shanghai lockdown). As well, in February, the Caixin manufacturing PMI index reached 51.6 (and passed the 50 bar for the first time since August 2022).

Real estate sales have gone up for the first time in 19 months. The 100 biggest developers have seen 15% higher sales in February compared to the same month in 2022. Though it is a modest increase after a 41.3% decrease in 2022 overall, it still confirms that the steps to support housing sales are having an effect.

For January and February combined, exports remain depressed, 6.8% lower than during the same period last year. Yet it is a less negative result than the 9.9% decrease of December 2022.

- Clearly, China’s economic recovery is under way and the government is confident enough to have set targets of a real GDP growth of “around 5%” for 2023 with the creation of 12 Mio. jobs (over a total employed population probably around 800 Mio). Inflation is expected to run at about 3% this year.

However, investments from the private sector seem not to have restarted. Savings are very high, households are refunding their mortgages potentially putting some small banks into loss territory. Entrepreneurs appear to be in a “wait and see” mood.

Both the President and the new Prime Minister (Li Qiang) have publicly re-emphasized the importance of the private sector and pledged equal treatment for Chinese and foreign private investments. No concrete policy measures have been carried out yet at the state level.

- High quality development and innovation have been re-iterated as the new source of China’s growth.

- And, as also expected, China has decided to take advantage of the abandonment of its zero-covid policy to re-establish and further boost its international economic relations. As a result, visa issuance lead times for Chinese wanting to visit European countries are now reaching months.

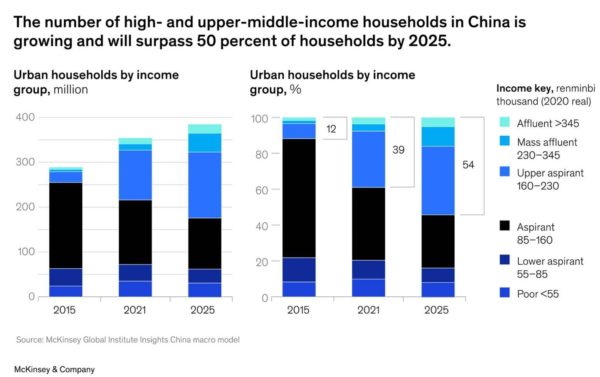

- With the employed population plateauing, the increased purchasing power of the middle class will be a key source of China’s GDP growth.

All in all, below is how McKinsey sees China’s middle class growing in the coming years:

International relations developments have not been as smooth as the economic ones, however:

The Geopolitics

- Still, as expected, China worked to cool down international tensions. It did so among others by preparing to receive the US Secretary of State in Beijing. The plan was derailed by the balloon incident. And though China initially apologized it then pushed back with animated responses.

In addition, Der Spiegel published details of some alleged weapons sales to Russia contemplated by China, days before China’s Foreign Ministry stated its position on the “Ukraine Crisis”. This position includes “playing a constructive role” in the resumption of peace negotiations.

The EU announced (as well as the US) that China providing weapons to Russia would be crossing an absolute red line and followed by sanctions. China’s then still Foreign Minister (Wang Yi) and now Politburo member said to the EU (Josep Borrell) that it will not provide weapons to Russia.

The US has announced further sales of missiles to Taiwan and a trip by Ms. Tsai Ingwen to the USA is under preparation to meet the US Speaker of the House (No 3 in the US leadership).

- Japan, Holland and South Korea are said to be joining the US export ban of state-of-the-art semi-conductors as well as the equipment and materials needed to produce them.

- This has prompted the President to state that the US is leading its allies to an “all-around containment, encirclement and suppression” of China and the new Chinese Foreign Minister to warn that “If the U.S. does not pump the brakes and continues to speed down the wrong path, no amount of guardrails can prevent derailing, and there will surely be conflict and confrontation“.

- However, Beijing mentioned it would welcome a visit of the US Secretary of Commerce. And in their closing speech and press conference, the President did not go back to conflictual aspects and the Prime Minister mentioned that the US and China must and can work together, both emphasizing the Chinese ability to overcome considerable challenges throughout history.

Given the international situation and China’s economic goals, a lot depends on China’s ability to deal with the export restrictions put in place by the US and other countries owning the IP and know-how to produce semi-conductors:

The Technology

- In January and February 2023, China’s imports of semiconductors and integrated circuits dropped 45% and 21% respectively. Unless China has been able to boost its local production enormously, this indicates that the US efforts at restricting sales of key semi-conductors to China are having a considerable effect.

- ChatGPT has been a shock and a source of many concerns for everyone but an even bigger challenge for China. The access to the site is blocked and there are calls for developing a home-grown service. Considering the embargo on high performance chips and the censorship requirements prevailing in China, experts see China failing behind in generative Artificial Intelligence.

- A new commission of the Communist Party has been formed to coordinate Science and Technology development to speed up technology development and self-reliance.

Our initial assessment

- Despite the harsh words of China’s leaders, we still believe that China will prioritize economic development for at least 2023.

Therefore, China will still look for ways to reduce international tensions in order to develop international business. A number of signs point to this direction, including the positive reply for a potential visit of Gina Raimondo, US Commerce Secretary, and a high increase in the Foreign Affairs Ministry budget (12.2%, against 7.2% for the military). This will naturally also depend on the same intention to reduce tensions coming from the USA. - As a result, it is difficult to imagine that China will support Russia militarily in a visible way, while at the same time making considerable efforts to boost its economic relations with the rest of the world. Indeed, the EU, the UK, North America, Japan and Korea accounted for over 44% of Chinese exports in 2022 and open military support of Russia would probably have a seriously negative effect on China’s international trade, said to be the source of over 20% of China’s total employment.

Additionally, there are reports of a first conversation to take place between the Ukrainian President and the Chinese one, after a possible visit of the Chinese President to Moscow.

Still, international companies keep evaluating and mitigating their supply chain risks in relation to China.

- The rebound in consumption of 2023, big or small, China’s post-covid international relations campaign and the focus on quality development will anyway continue to provide interesting and most probably increasing business opportunities for Swiss companies.